"if HP can prove its claims of financial wrongdoing at Autonomy, the company could potentially recover a portion of the more than $5 billion loss it attributes to those problems. HP has already stated that it is likely to pursue financial redress through the civil courts. Autonomy's founder and former CEO Mike Lynch has emphatically denied wrongdoing, but HP's management would not have made such serious allegations unless they had solid evidence. (The need for thorough investigation probably explains why the company waited until now to disclose the accounting problems.)"

Thursday, November 29, 2012

HP's Big Autonomy Flap: Much Ado About Not Much News - Seeking Alpha

"if HP can prove its claims of financial wrongdoing at Autonomy, the company could potentially recover a portion of the more than $5 billion loss it attributes to those problems. HP has already stated that it is likely to pursue financial redress through the civil courts. Autonomy's founder and former CEO Mike Lynch has emphatically denied wrongdoing, but HP's management would not have made such serious allegations unless they had solid evidence. (The need for thorough investigation probably explains why the company waited until now to disclose the accounting problems.)"

Wednesday, November 28, 2012

Google Fiber praise, Comcast criticism | BGR

http://bgr.com/2012/11/28/google-fiber-praise-comcast-criticism/

1Gbps Download and HD tv. $120/mo. What do I need my cable Co for again?

Thursday, November 22, 2012

Robert Reich (Why You Shouldn't Shop at Walmart on Friday)

http://robertreich.org/post/36219730368

" Most new jobs in America are in personal services like retail, with low pay and bad hours. According to the Bureau of Labor and Statistics, the average full-time retail worker earns between $18,000 and $21,000 per year.

But if retail workers got a raise, would consumers have to pay higher prices to make up for it? A new study by the think tank Demos reports that raising the salary of all full-time workers at large retailers to $25,000 per year would lift more than 700,000 people out of poverty, at a cost of only a 1 percent price increase for customers.

And, in the end, retailers would benefit. According to the study, the cost of the wage increases to major retailers would be $20.8 billion — about one percent of the sector's $2.17 trillion in total annual sales. But the study also estimates the increased purchasing power of lower-wage workers as a result of the pay raises would generate $4 billion to $5 billion in additional retail sales."

Wednesday, November 21, 2012

Forstall's Departure Indicates a Lack of Vision at Apple, Says Analyst - NASDAQ.com

Into the breach steps... Microsoft?

It's still any body's game!

It could be HP's if they have the guts!

By the way if you've purchased anything at an Apple Store lately you'll see what this guy is talking about. Employees too busy being hipster to help customers.

"Further, Chowdhry said that Apple is "not as customer centric as it used to be, and the rate of innovation is declining when the rate of innovation of competitors has dramatically risen."

Long-term, Chowdhry believes that Microsoft may "dislodge Apple in computational innovation."

"Apple's innovation is sputtering," said Chowdhry. "Why is that Apple, the company that brought touch to phones and tablets, stopped just there and did not bring touch to notebooks and iMacs? Why is it that Apple brought high-resolution screens to some iMacs and some MacBooks and not to all devices? High-resolution screens are a commodity today."

As it stands, Chowdhry thinks that Microsoft has "almost dislodged Apple by being the most innovative computing company that handsomely marries touch with stencil on high-resolution screens." "

With HP Shares Falling, Views of Director Whitworth Take on Importance – AllThingsD

The vultures circle... Whitworth's intention is obvious. Even before the latest Autonomy debacle, I believed a breakup of HP is inevitable - and it will happen in 2013.

"As of June 1, SEC filings (see the most recent one here) show that Whitworth, through Relational, has doubled his holdings in HP, and now controls more than 34.5 million shares, a stake that is approaching 2 percent of the shares outstanding. That would put Relational on track to be the eighth-largest institutional holder of HP shares.

At this point, it's worth looking at Whitworth's history: Last June, after acquiring a 6 percent stake in L3 Communications, Whitworth pushed for a breakup of that company. The result was the spinoff of a $2 billion unit that is to be called Engility.

Also in 2011, after amassing a stake of nearly 4 percent, Whitworth pushed for — and ultimately won —the breakup of the industrial conglomerate ITT. In that case, Whitworth threatened a nasty proxy fight by nominating himself and two other Relational officers to that company's board. It ultimately broke itself into three publicly held pieces: ITT, ITT Excelis, and Xylem.

Whitworth's latest target appears to be soft-drink giant PepsiCo. Having accumulated a stake amounting to about 0.6 percent of its shares outstanding, he is said to have agitated for the separation of its slow-growing beverage business from its faster-growing snacks line."

.

Tuesday, November 20, 2012

HP's ousted Apotheker to take home $25 million

http://money.cnn.com/2011/09/22/technology/hp_leo_apotheker_severance/index.htm

It barely registers against $8.8B in write down, but just on principle, and as an ex-HP employee, I want Leo's money back.

"Apotheker will take home $25.4 million.

Mark Hurd, who exited HP scandalously, received a cash severance payment of $12.2 million.

HP CFO Cathie Lesjak filled the gap between Hurd and Apotheker. As thanks for her three-month CEO stint, she was granted a $1 million cash bonus and $2.6 million in stock grants in recognition of her "exceptional service," according to a regulatory filing.

And Carly Fiorina, who resigned (read: was shoved out the door) as CEO in 2005, was given a $21.4 million cash severance in addition to another $21.1 million in stock grants.

In all, the ousters of its past three CEOs, including the bonus for the interim CEO, have cost HP $83.3 million."

.

Hewlett Packard Implodes After Disclosing Accounting Fraud At Autonomy plc Business | ZeroHedge

" That Hewlett Packard would miss results (it did, with revenues coming at $30.0 billion on expectations of $30.4billion, guiding Q1 ESP $0.68-$0.71 on expectations of $0.85) is no surprise to anyone who had followed the stock, and/or seen the recent dump of half of Seth Klarman's stake in the name (as was pointed out here previously). What was not only surprising, but shocking is that as part of its earnings announcement, HPQ took a $8.8 billion impairment charge to intangiblesand earnings, primarily as a result of what it said was "serious accounting improprieties, disclosure failures and outright misrepresentations at Autonomy Corporation plc that occurred prior to HP's acquisition of Autonomy and the associated impact of those improprieties, failures and misrepresentations on the expected future financial performance of the Autonomy business over the long-term." As a reminder, HPQ bought Autonomy plc for $10.3 billion in August 2011. We now learn that anywhere between 50% and 80% of this purchase price was based on meaningless numbers and fraud. $10.3 billion is also about40% of what HPQ's market cap will be when the stock opens down at least 10%. And this is how one destroys shareholder value. One in this case being the company's former CEO Leo Apotheker, whose executive decisions and lack of diligence have left the company in a stateof complete disaster.What was Leo's punishment for his brief tenure on top of HPQ and swath of absolute value destruction? $25,000,000 in all in comp."

.

The Scary Story For Hewlett Packard Shareholders In One Chart | ZeroHedge

http://www.zerohedge.com/news/2012-11-20/scary-story-hewlett-packard-shareholders-one-chart

Pretty much says it all.

" Earlier today Hewlett Packard stunned investors by announcing that its had effectively bungled a massive acquisition, that of Autonomy plc, despite extensive prior warnings about the accounting practices of the UK firm (for which it appears Deloitte will now have to take the blame), by paying over $10 billion for a transaction that is now clear will provide zero income statement benefit. The one problem, however, is that HP incurred a massive debt load to fund EBITDA and Cash Flow which will never materialize.The result: a capital structure that is now appropriate of a B1/B+ rated company, i.e., one whose debt needs would be serviced by a firm like Jefcadia, and therefore whose time to default in years can be counted on the fingers of one hand. The chartbelow explains it all: why shareholders should just get out while they can, and also explains why despite, or rather due to, endless central bank mingling, cash flowsstill, oddly enough, matter. Oh, and those hoping the HPQ dividend continues uninterrupted in perpetuity, hope again."

.

HPQ: Blame Game Swirls as Analysts Warn Raft of Worries to Continue - Tech Trader Daily - Barrons.com

Ouch, ouch, ouch.

"In our view, innovation is the only way out of this wormhole, and spending $384M/qtr on buybacks and dividends siphons off cash that should be in R&D. "

.

Monday, November 19, 2012

Hostess took Union members self funded pensions without their authorization to pay their debts - will not be paid back under bankruptcy

http://www.reddit.com/r/politics/comments/13eufq/hostess_took_union_members_self_funded_pensions/

From Reddit, more discussion about the Hostess bankruptcy including a discussion of whether "stolen pension" is accurate: it is not theft but breech of contract.

Also, read the comments to learn about medical benefits to union workers. What are they complaining about?? I worked for a large multinational and didn't get benefits like that.

Daily Kos :: Inside the Hostess Bankery

http://m.dailykos.com/story/2012/11/18/1162786/-Inside-the-Hostess-Bankery

"In July of 2011 we received a letter from the company. It said that the $3+ per hour that we as a Union contribute to the pension was going to be 'borrowed' by the company until they could be profitable again. Then they would pay it all back. The Union was notified of this the same time and method as the individual members. No contact from the company to the Union on a national level.

This money will never be paid back. The company filed for bankruptcy and the judge ruled that the $3+ per hour was a debt the company couldn't repay. The Union continued to work despite this theft of our self-funded pension contributions for over a year. I consider this money stolen. No other word in the English language describes what they have done to this money."

.

Wednesday, November 14, 2012

Black Friday slips into 'Grey Thursday' as retail giants face staff backlash | Business | guardian.co.uk

Jackie Goebel has worked for Walmart for 24 years, but this year, for the first time, she will spend the Thanksgiving holiday working at the retail giant. Like many of her colleagues, she is not happy. "Walmart has become a company so obsessed by the bottom line and greed that it no longer values the importance of the people and families that work for it," she said.

A Walmart spokesman said "Last year, our highest customer traffic during the Black Friday weekend was during the 10pm hour on Thursday. According to the National Retail Federation, Thanksgiving night shopping has surged over the past three years. Most of our stores are open 24 hours and, historically, much of our Black Friday preparations have been done on Thanksgiving, which is not unusual in the retail industry."

As the world turns...

See the article for the full graphic. I'm just fascinated by all the tawdry details. Not just one woman, but two fighting over him! What a plot twist that the woman told to back off was a 2nd girlfriend! How does this movie end?? Reminds me of that love triangle between the 3 astronauts where the one woman drove cross country to knock off the other girlfriend. Also reminds me of HP's Mark Hurd where he tried to seduce his love interest by taking her to an ATM and printing out his bank balance for her to see. Just because you've reached the pinnacle of business or military success, doesn't mean you won't get totally unhinged by a love affair.

Wednesday, November 07, 2012

Saturday, November 03, 2012

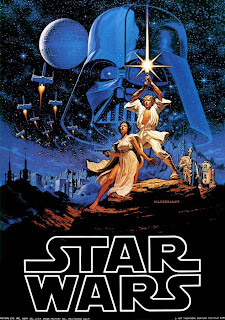

MarketSaw - 3D Movies, Gaming and Technology: EXCLUSIVE: More Secret Details Revealed From My Original STAR WARS Source! SKYWALKER Returns Again!! (6 more movies planned)

http://marketsaw.blogspot.com/2012/11/exclusive-more-secret-details-revealed.html

Star Wars was the defining movie of my generation. I couldn't be more excited to hear about Disney's plans! And, what a great excuse to expand the Star Wars section of Disney Hollywood Studios!

"Luke Skywalker, Han Solo, Chewbacca, Princess Leia, C3PO and R2D2 are I am assured to feature prominently in the new trilogy, as was always the idea. Apparently some have already been approached. Quite a while back too to my understanding. Hamill is a certainty.

There are two trilogies planned, all following an original overview by Lucas, which was always planned as a multi generational saga. Movies 10 -12 are from my understanding about the offspring of the Skywalkers, set many years later with the surviving cast playing much older versions of themselves and featuring a female protagonist named Skywalker."

.